April 21st, 2020- Governor Pritzker and Secretary Hagan of the Illinois Department of Financial and Professional Regulation (IDFPR) announced that Illinois has secured relief options with twenty private student loan servicers to expand on the protections the federal government granted to federal student loan borrowers. These new options stand to benefit over 138,000 Illinoisans with privately held student loans.

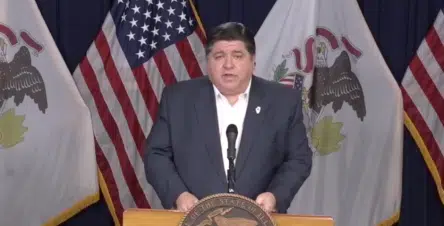

“I’m happy to announce that, as of today, more student loan borrowers in Illinois will now get relief,” said Governor JB Pritzker. “IDFPR has worked tirelessly to secure loan relief options with twenty student loan servicers. Impacted borrowers can immediately contact their loan provider to get relief with these new options.”

“At this unprecedented time of financial hardship, it was essential to find a way to provide relief to all student loan borrowers who are struggling financially due to the COVID-19 pandemic. I’m pleased that we were able to work with several states and servicers to get this done for our Illinois students,” said Secretary Deborah Hagan, Secretary of the Illinois Department of Financial and Professional Regulation.

The federal CARES Act provided much-needed relief for students with federal loans, including the suspension of monthly payments, interest, and involuntary collection activity until September 30, 2020. However, the CARES Act left out millions of student loan borrowers with federal loans that are not owned by the US Government as well as loans made by private lenders.

Under this new initiative, Illinoisans with commercially-owned Federal Family Education Program Loans or privately held student loans who are struggling to make their payments due to the COVID-19 pandemic will be eligible for expanded relief. Borrowers in need of assistance must immediately contact their student loan servicer to identify the options that are appropriate to their circumstances. Relief options include:

- Providing a minimum of 90 days of forbearance

- Waiving late payment fees

- Ensuring that no borrower is subject to negative credit reporting

- Ceasing debt collection lawsuits for 90 days

- Working with the borrower to enroll them in other borrower assistance programs, such as income-based repayment.

Additionally, if regulated student loan servicers are limited in their ability to take these actions due to investor restrictions or contractual obligations, servicers should instead proactively work with loan holders whenever possible to relax those restrictions or obligations. Prudent and reasonable actions taken to support relief for borrowers during the pandemic will not be subject to examiner criticism from IDFPR.

To determine the types of federal loans they have and who their servicers are, borrowers can visit the Department of Education’s National Student Loan Data System (NSLDS) at nslds.ed.gov or call the Department of Education’s Federal Student Aid Information Center at 1-800-433-3243 or 1-800-730-8913 (TDD). Borrowers with private student loans can check the contact information on their monthly billing statements.

If a borrower is experiencing trouble with their student loan servicer, they are encouraged to contact the following and file a complaint:

- IDPFR Division of Banking 217-785-2900 for information or to file a complaint with IDFPR

https://www.idfpr.com/admin/banks/DoBcomplaints.asp - Attorney General’s Student Loan Helpline at 1-800-455-2456 or file a complaint with the Office of the Illinois Attorney General

https://illinoisattorneygeneral.gov/consumers/filecomplaint.html - The Consumer Financial Protection Bureau

https://www.consumerfinance.gov/complaint/